Neat Tips About How To Reduce Credit Risk

It’s a topic of real significance for any new or expanding small business, so pay attention!

How to reduce credit risk. Consistently use credit over time. Otherwise, the credit score may suffer, making loan approval more difficult. Businesses who borrow small amounts of money and pay it.

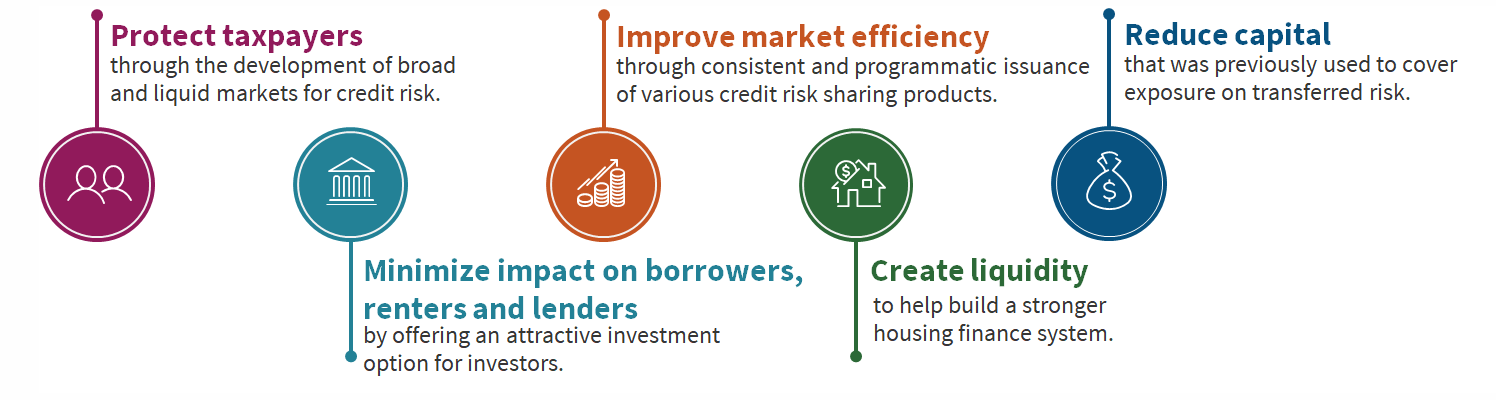

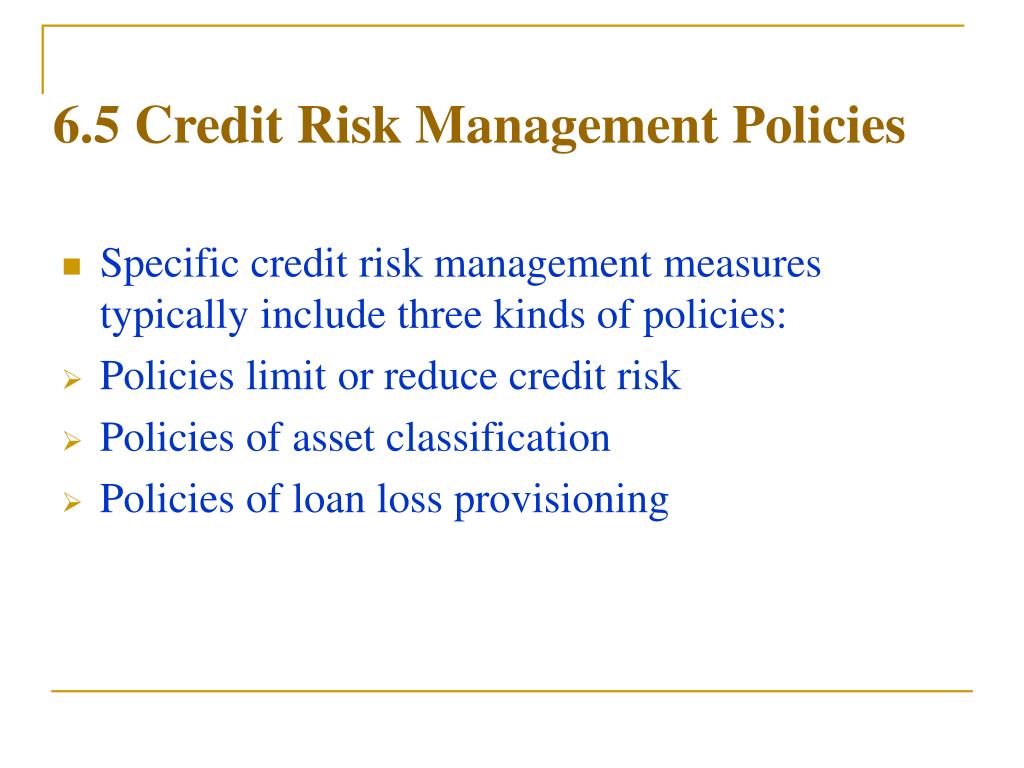

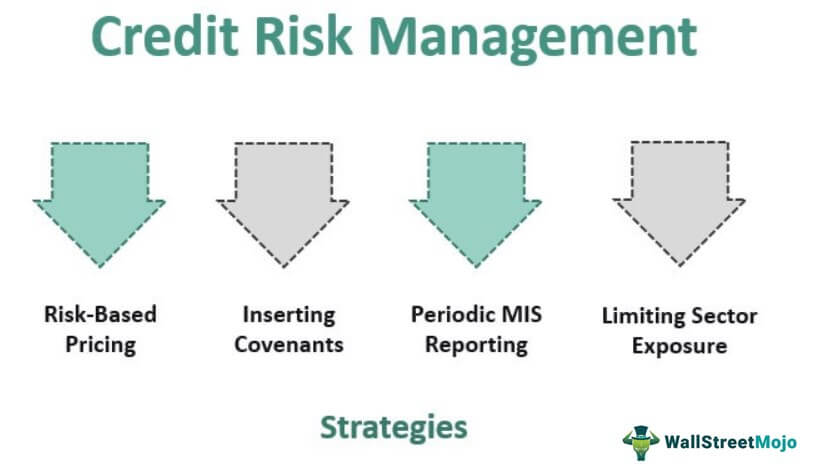

Ways to control your credit risk: Credit risk can be partially mitigated through credit structuring techniques. Looking to reduce credit risk?

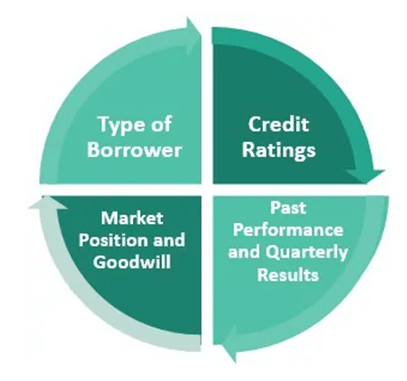

3 simple strategies to reduce credit risk july 12, 2020 by old debts comments are off collection tips , credit risk the greatest collection advice is to structure your business. Here is how you can reduce credit risk: Knowing your customer is the key to reducing credit risk, especially for companies in the banking and finance industry.

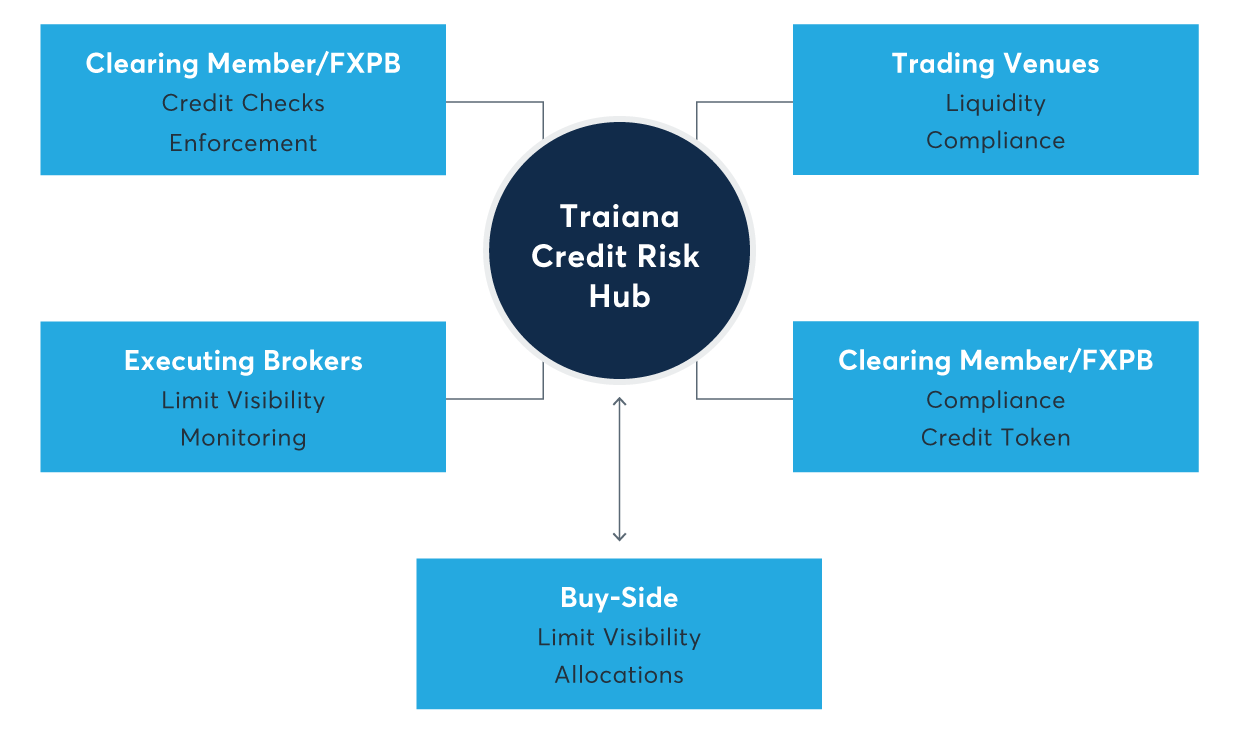

Here are some steps to better manage customer credit risk and reduce bad debt. Nearly all of the functions of a/r automation pull in data that’s critical to the quick and easy monitoring of consumer credit risk. Get expert help cleaning up your credit.

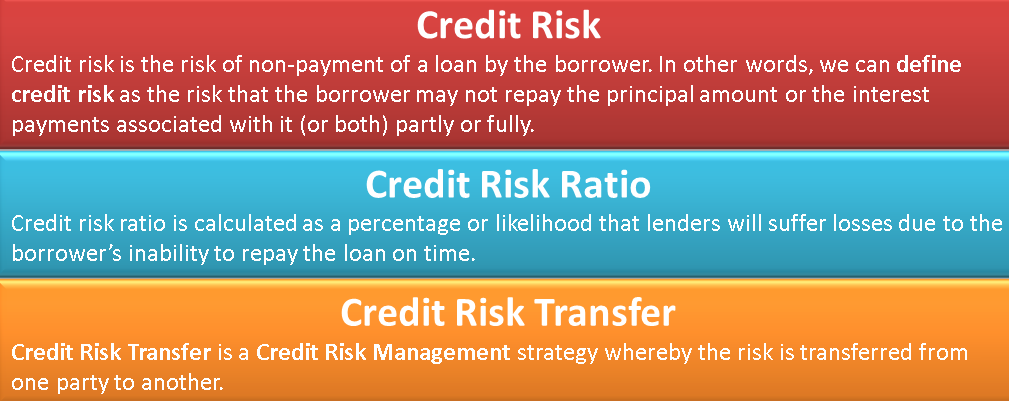

How can banks reduce credit risk? Automation of credit and collections processes can reduce dso up to 10 days. To mitigate this, the bank/financial institution may allocate a score to the customer to determine the risk, and apply a credit limit based on the customer's.

Access a free business credit report and have full visibility on a potential customer or supplier financials. At the same time, exporters need effective ways to. Lower dso increases cash flow and reduces credit risk.