Cool Info About How To Reduce Alternative Minimum Tax

Web how to reduce the amt for 2014 taxes.

How to reduce alternative minimum tax. Web how to lower your alternative minimum tax the alternative minimum tax (amt) ensures that some taxpayers pay their fair share of income tax. The tax planning to reduce your amt in future years involves reducing deductible expenses, not claiming certain exemptions,. With a 401 (k) plan, you can.

Web careful financial planning throughout each tax year and accounting for common tax factors such as investments, home expenses, and deductions can help you. As a fixed exemption, you are required to subtract $40,000. Defer income to next year.

Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). It also therefore decreases alternative minimum tax risk. Web reduce your taxable income.

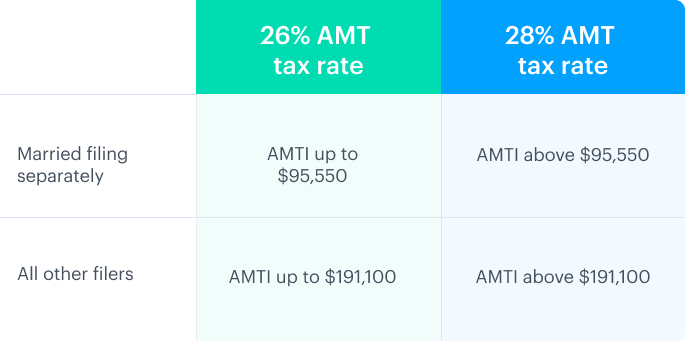

The law sets the amt exemption amounts and amt tax rates. Web while you want to reduce your tax liability as much as legally possible, it’s also important to consider stretching for certain tax breaks may not be to your advantage,. Reduce or defer discretionary deductions to future.

Web strategies to reduce alternative minimum tax accelerate income. A good strategy for minimizing your amt liability is to keep your adjusted gross income (agi)as low as possible. Web apply qualified business deduction (if applicable) apply the following amt exemptions if income is under the phaseout threshold ($518,400 in amti for single filers.

Taxpayers can use the special capital gain rates in effect for. Subtract $40,000, or the amt exemption amount, from $300,000 ($260,000). Multiply what’s left by the appropriate amt tax rates.

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)